Funding Details

What is the funding for?

Step Up offers 0% interest loans from £5K to £30K to support the trading activities and strategies driving your business growth. This includes concepts, products, or services you have used or are currently using to expand your business.

For example:

- A marketing campaign that brought in more customer revenue than it cost.

- A product that is flying off the shelves.

- An event or workshop you organised that sold out with a waiting list.

- A piece of equipment you are running at full capacity and need another one to keep up with demand.

We know that this might be the first time you apply for repayable funding for your enterprise, and it can be daunting to understand what investors are looking for – and how it’s different to what grant funders look for. The Step Up process is designed to be a practical exercise in investment readiness. When you apply, you’ll explain how the strategies you want to fund with a Step Up loan will help you to grow your business – and therefore be able to repay the loan. And you’ll design your own repayment plan that works with your cashflow.

Eligibility

To be eligible for Step Up, your enterprise:

- Has a registered office in Scotland.

- Operates primarily for the benefit of people or communities in Scotland.

- Its activities do not involve political campaigning or the advancement of religion.

- Has an asset-locked constitution and is registered with either Companies House, The Office of the Scottish Charity Regulator (OSCR), or the Mutual Public Register.

- Has a business bank account in the name of the social enterprise.

- Has a board with a minimum of two directors/trustees in place, of whom no more than half are connected persons AND no more than half are employed by the enterprise. (If you need further guidance on this, please see Step Up FAQs.)

- Can provide evidence of successful trading and demonstrate the potential to become financially sustainable.

- Can provide evidence of the direct, measurable social or environmental impact it delivered.

- Adheres to the Scottish Government Fair Work policy, including paying the Real Living Wage and providing appropriate channels for effective workers’ voice.

AND

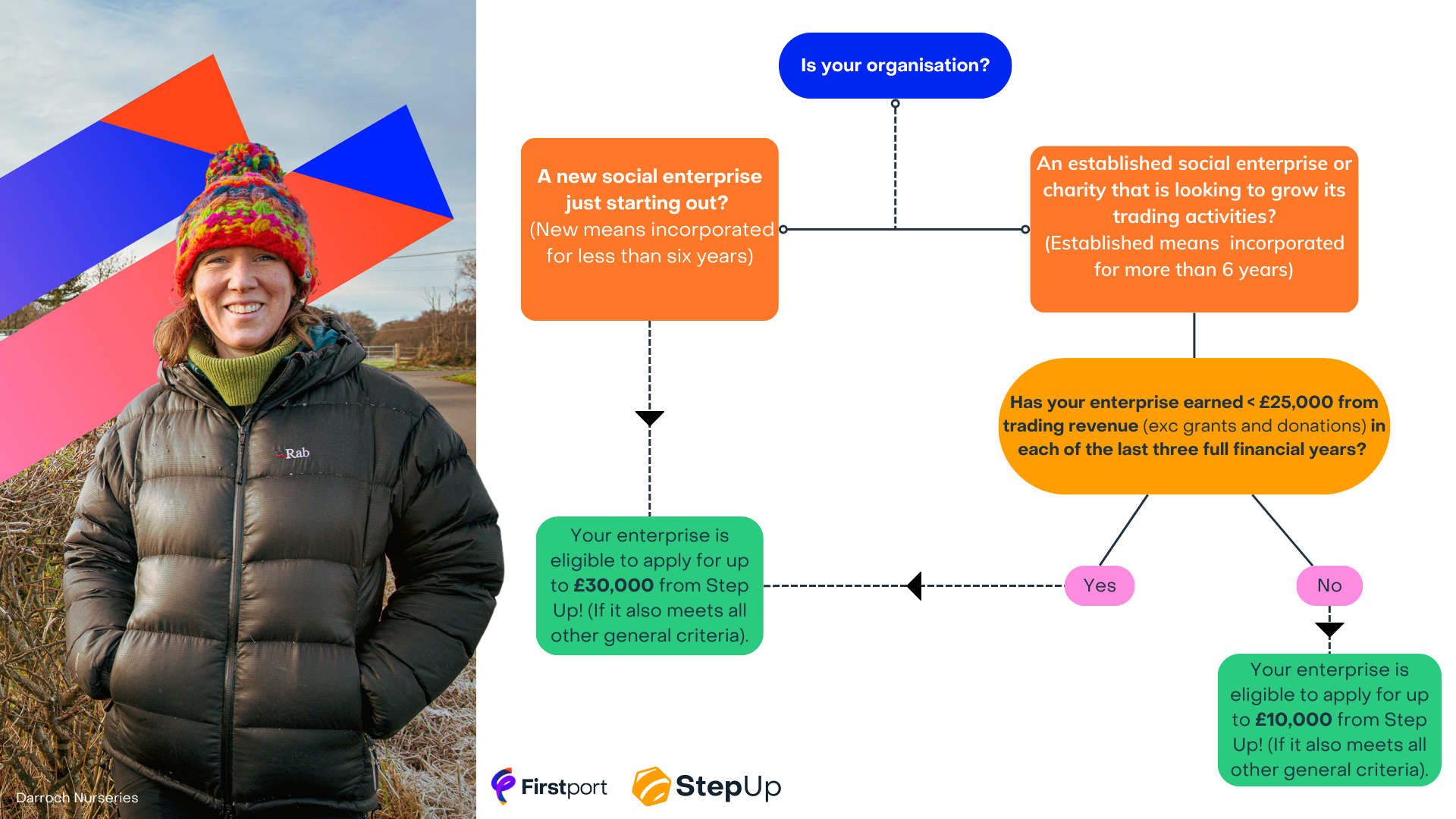

If your organisation is seeking to borrow over £10,000, your enterprise must be EITHER:

- less than six years since incorporation as an asset-locked body.

OR

- an organisation of any age but have earned less than £25,000 in trading revenue (excluding grants and donations) in each of the last THREE full financial years.

If your organisation is part of a group structure, eligibility rules apply to all entities in the group.

Exclusions apply for previous Boost It awardees – please see the Application Guidance for details.

How does the loan work?

The loan is 0% interest, so you repay the exact amount you borrowed. As part of the application process, you will propose a repayment plan. Repayments might be a flat rate which is the same every month, in one or more lump sums, or staggered with lower repayments initially building up over time.

- You must repay loans of £10k or under within two years.

- You must repay loans over £10k within five years.

If you have fully repaid a loan, you can apply again. (A lifetime limit of £50,000 per enterprise in Step Up loans applies).

How do I apply?

We designed the application process to be straightforward and to help you get into an investment mindset. The application form will ask you to think about the information you need to provide to secure repayable investment, which will help you with any future applications you make for investment.

To apply for a Step Up loan, you will need to:

- Tell us about your organisation and who is involved.

- Outline the trading activity or strategy you would like to repeat.

- Provide evidence that it has previously been commercially successful (i.e. has earned more trading revenue than it cost to implement).

- Specify how much you would like to borrow and what you will spend it on.

- Propose a repayment schedule and provide a cash flow forecast to demonstrate it.

You must also provide your most recent annual accounts (if available) and management accounts for the period between last annual accounts (or start date) and present. (Organisations over 6 years old applying for over £10,000 must provide three years annual accounts that demonstrate income from trading revenue of less than £25,000 in each year.)

You may optionally add a business plan. Please read the guidance before applying.

If this is your first time applying for repayable investment, we recommend you contact our LaunchMe team first – they can help you set yourself up for success before you apply.

Once you submit your application, you will receive a decision within three weeks. Between 15th to 31st December no assessments or decisions take place, so you will receive a decision within six weeks of applying.

What happens if I am successful?

If you are successful in your application:

- We will agree on your repayment plan together.

- We will undertake ID checks on your organisation’s registered directors/trustees. (Please ensure that they have consented for their details to be shared with us according to our data policies.)

- We will ask you to sign a loan agreement.

- You must agree to submit annual accounts and quarterly management accounts to us. Keep receipts or other evidence for spending for audit purposes.

- We will arrange an automated payment system to collect your proposed repayments. You will know the date we will collect each repayment.

Step Up is a funding programme only – our Investment Managers can answer questions about your loan and help you with any problems with repayment but won’t be able to provide business support. If you need help or advice on growing your social enterprise, please contact Just Enterprise.

What happens if I am unsuccessful?

You may not be successful the first time you apply, but you will receive a reason for the decision. Don’t lose heart – remember that this application process is a learning exercise for securing repayable investment.

If you can address the feedback, you can reapply as soon as you like. It might be something you can fix quickly. However, if you need further work on your business to increase your chances of success, you can seek support from our LaunchMe investment readiness team.

Common reasons for applications being unsuccessful include:

- Not giving us enough evidence that your trading activity or strategy has been successful in the past.

- Applying to fund a new project unrelated to previous activity.

- Not giving us enough detail in your narrative answers or cashflow forecast.

- Forecasting unrealistic cashflow figures.

- Forecasting a negative cash balance at any point during the proposed term of the loan.

- Requesting an excessively large amount relative to the previous iteration of your growth strategy.

- Proposing an unrealistic or unsuitable repayment plan.

Ready to apply?

To apply for Step Up, you need to create an account in our Application Portal:

- Click on the Apply Now button at the top of this page.

- If you have never applied for a Firstport grant or loan before, you will need to register to create an account and password.

- If you have applied before, you will have an account in our system already. Select ‘Forgot Password’ and follow the instructions to set up a new password.

- Once you log in, click on the Apply tab, select Step Up Application from the drop-down list and fill in your details.

- Once you have completed your application and uploaded the relevant documents, you can submit it.

- You will receive an email confirmation and will hear back from our team within the timescales provided.

Have a question?

If our FAQs doesn’t answer your question, our Investment Team is introducing ‘Chat to our experts during Social Investment Office Hours’. Click here to book your place.

Also, you can contact us via our Contact Us page or by phone at 0131 564 0331.

Downloads

-

Step Up Application Guidance

This document will guide you through each section of the application form. Please read thoroughly before starting an application.

DOWNLOAD -

Step Up Application Form -Word version

You can use this form to see all the questions in the application form to help you prepare and draft your answers.

DOWNLOAD -

Step Up Cashflow template

DOWNLOAD